Comparing Affirm and AfterPay — The Yin and Yang of BNPL

Table of Contents

Summary

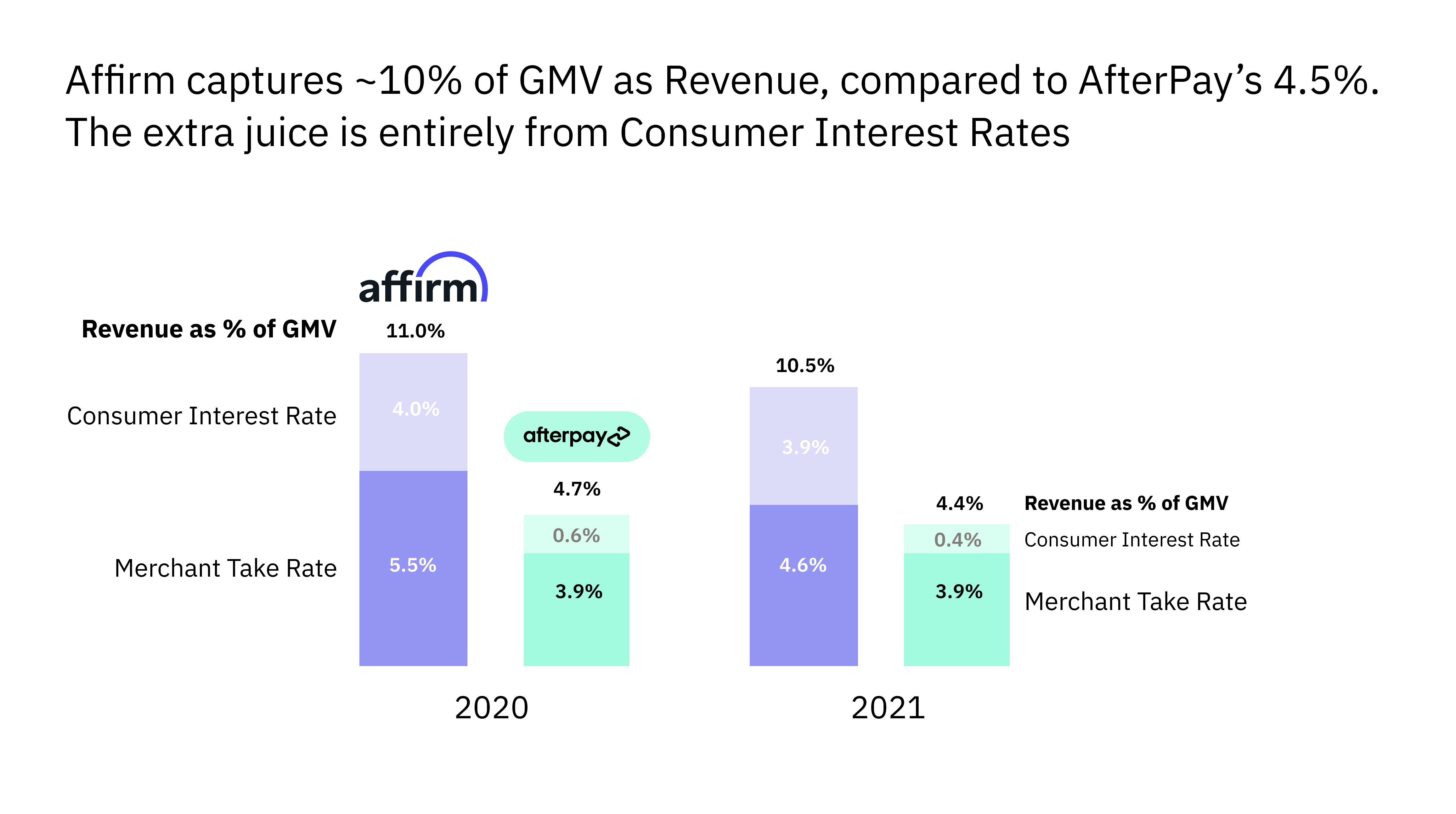

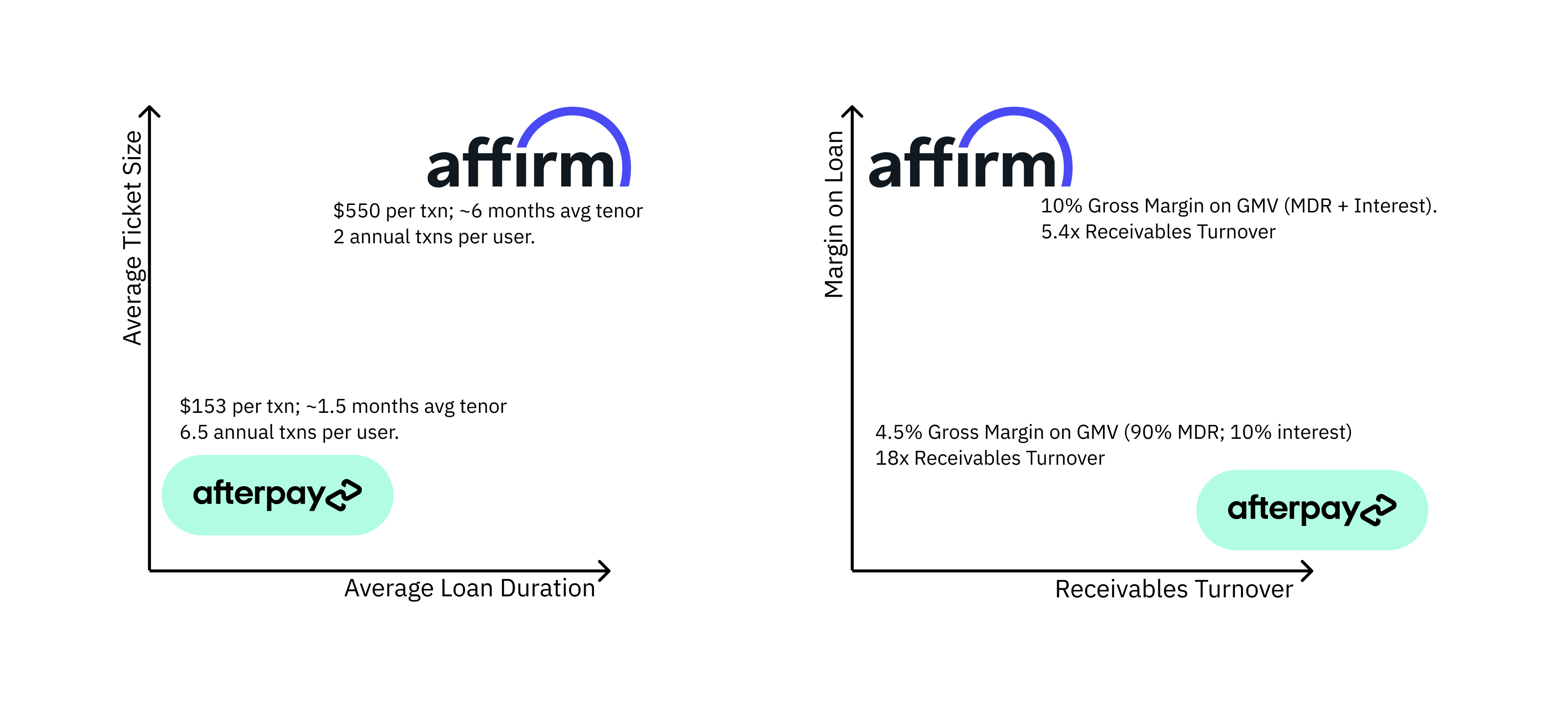

- Affirm and AfterPay deploy diametrically different business models. While Affirm monetizes both the merchants and the customers on its platform, AfterPay predominantly relies on Merchant Discount Rates for monetization with minimal interest burden on customers. This results in Affirm generating revenues similar to AfterPay's on a GMV only half as large.

- However, in choosing to monetize both sides, Affirm finds itself servicing higher Average Order Values ($500+ v/s $150) with a longer receivables cycle (5 Receivable turns per year v/s AfterPay's 17 turns per year) leading to significantly lower aggregate yield on capital.

- As such, Affirm and AfterPay represent divergent bets on the evolution of American eCommerce and spending power. AfterPay is a demand curation service combined with a checkout lubricant. AfterPay's focus is on discovery and conversion in the high frequency/ low-value space, while Affirm is an affordability solution. AfterPay's marketing and discovery DNA will continue strengthen following its merger with Square.

Affirm gets twice the juice for the same GMV

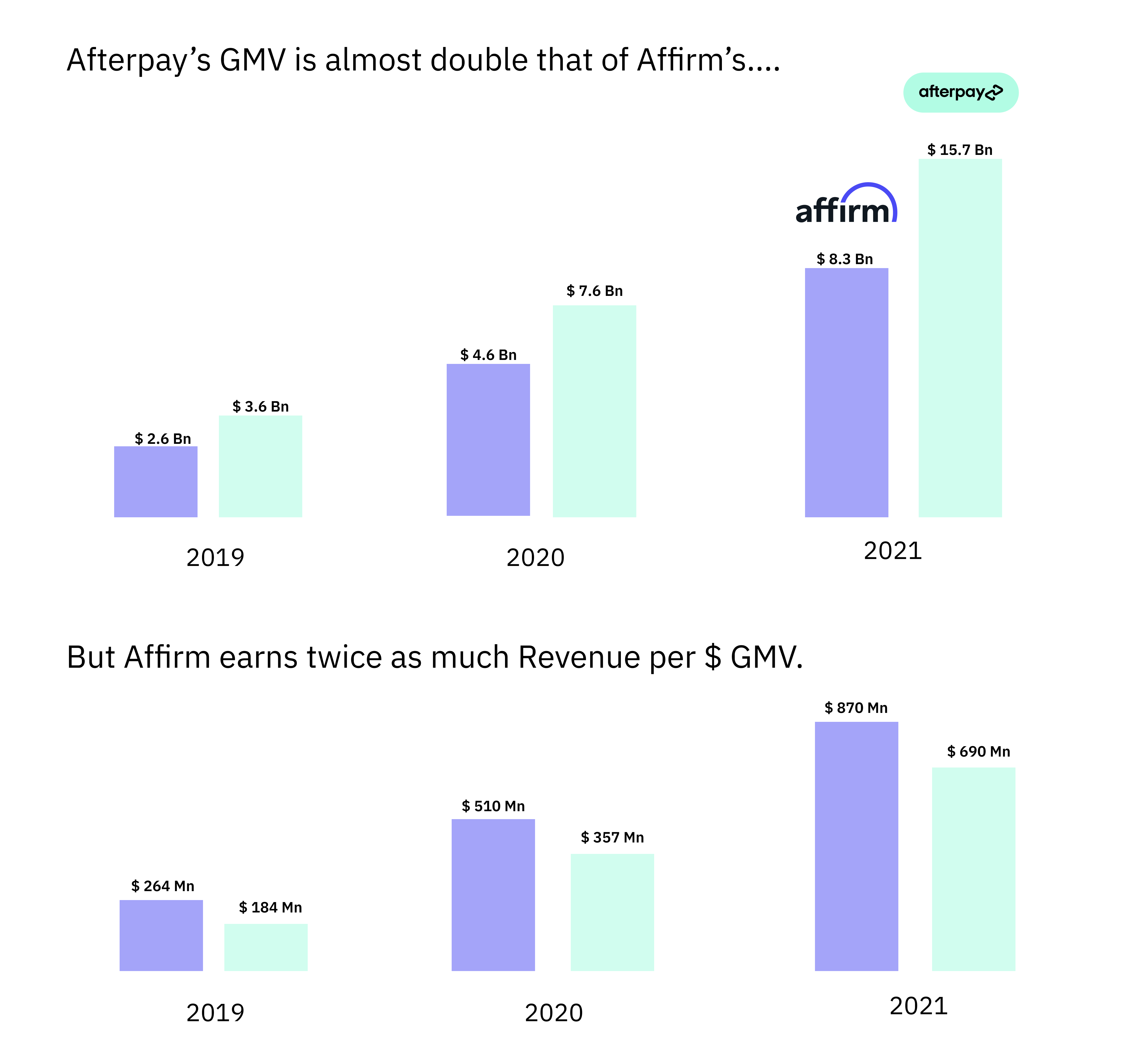

The chart below compares the GMV processed by Affirm and AfterPay over the last three years. AfterPay has consistently dominated Affirm in GMV processed. AfterPay's broader merchant base (100K merchants in FY2021, with 28K in USA) and a larger customer base (16.2 Mn in FY 2021 v/s Affirm's 7.1 Mn) allow it to rack up consistently large GMV numbers. However, it is Affirm that earn more revenue per dollar of GMV serviced.

Affirm monetizes its GMV better by charging both the merchants and the customers. Merchants are on average charged a discount rate of ~4.5% and customers are on average charged an interest rate of ~4% as part of Affirm's monetization strategy.

In order to justify the higher charges, Affirm focuses on high-value transactions where affordability can be a concern.

However, AfterPay's higher book turnover generates higher return on invested capital

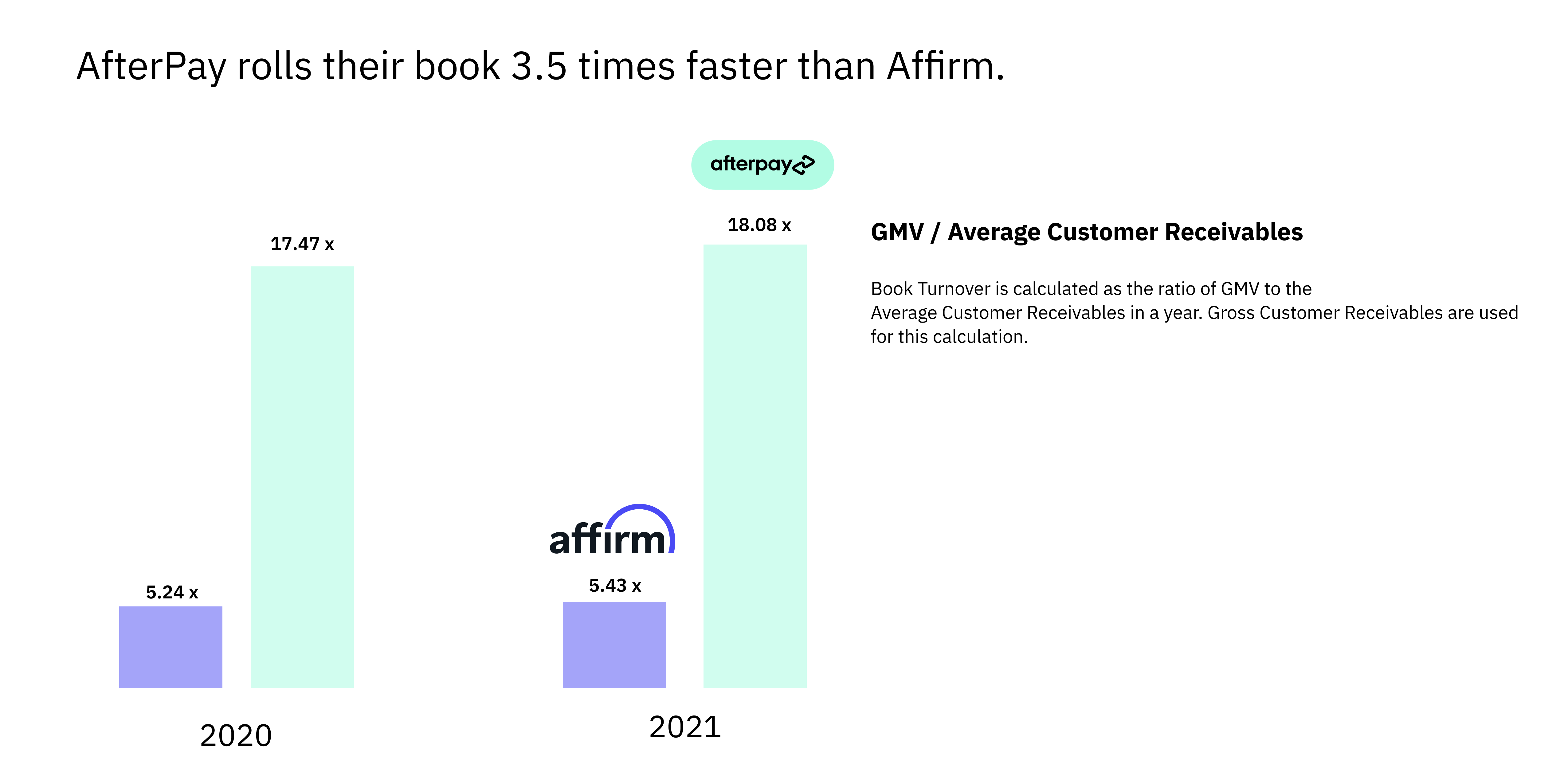

Affirm's higher margins on GMV come with a catch: Affirm needs to wait longer to collect back the loans it made to customers. This means that Affirm needs more capital than AfterPay to service the same amount of GMV.

The graph below shows how many times Affirm and AfterPay turn their receivables book around. We see that AfterPay rolls their receivables an average of 17 times, almost once every three weeks. In contrast, Affirm rolls their book only 5.5 times; in other words it takes Affirm over two months to collect back and re-issue an earlier loan.

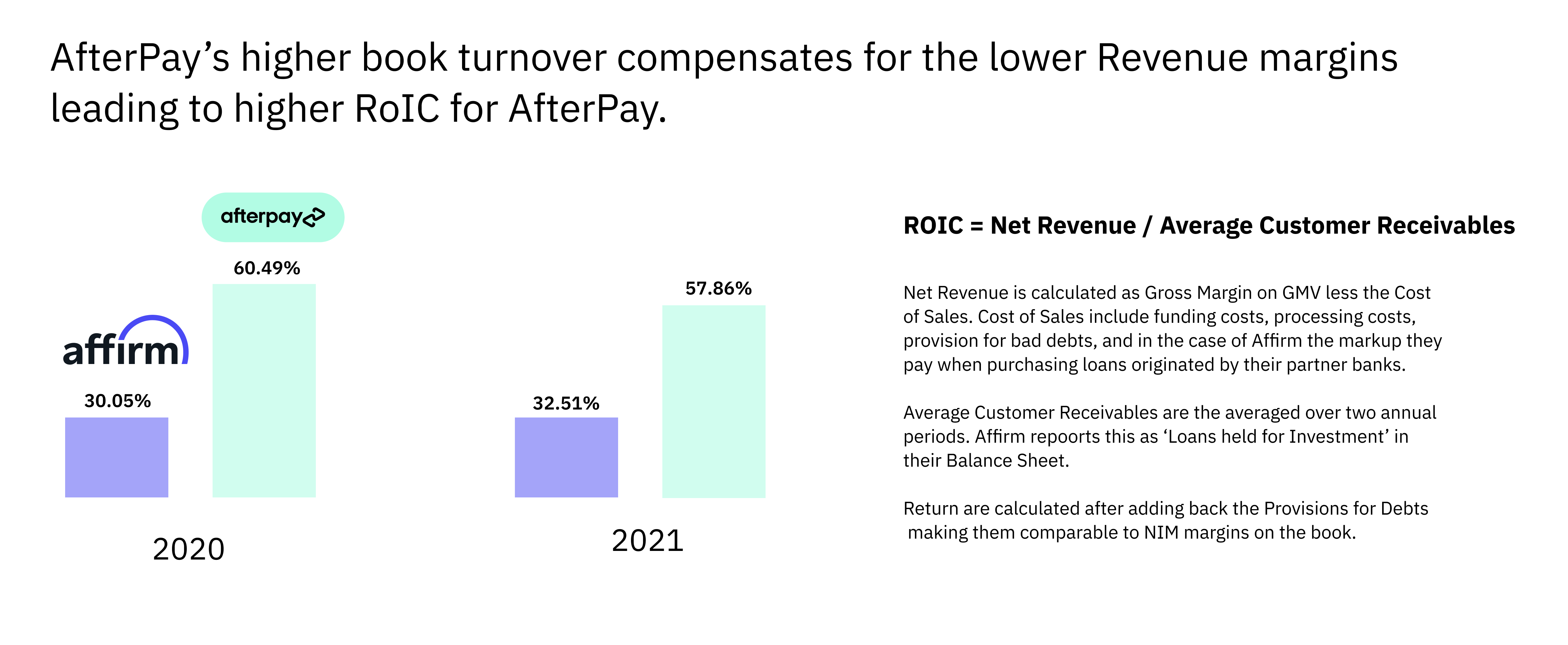

AfterPay's ability to roll its book faster allows it to compensate for the lower Gross Margin it earns on GMV. The graph below shows the ratio of Net Revenue to the average balance of receivables on Affirm's and AfterPay's book. AfterPay's advantage from its faster turnover is evident.

Affirm recognizes this yield calculation in their S-1 filing. From page 97, we see

As an annualized percentage of average loans held for investment, total interest income decreased from approximately 21% to 18%. This decrease was driven by an increase in the amount of 0% APR loans being held on our balance sheet as a percentage of the total loans held for investment, which averaged 27% during the three months ended September 30, 2019, compared to 45% during the three months ended September 30, 2020. The shift was largely due to strong volume of longer-term 0% APR loans.

Affirm might be angling for a slice of this low-value, high-frequency pie. Affirm's recent partnerships, with Spotify and Amazon, and product launches like the Debit+ card suggest that Affirm is at least slightly interested in low-margin, high-frequency transactions. However, it's unclear if Affirm's origination bank partners would be comfortable processing such smaller ticket size loans.

Affirm and AfterPay are distinct bets on the evolution of US ecommerce and payments.

The following 2x2 diagrams summarize the Yin-Yang nature of Affirm and AfterPay.

Affirm is primarily an affordability play, rather than a discovery play. As such Affirm is spiritually closer to (and will need to compete closely with) credit cards. The archetypal products serviced by Affirm are consumer durables like Peloton (Peloton contributes roughly a third of Affirm's revenue). Expect Affirm to become entrenched in the space of high-margin, high-value consumer goods that are purchased after significant research and deliberation.

AfterPay on the other hand is a marketing and discoverability partner for the growing Direct-to-consumer market with the credit feature serving more as lubricant to reduce friction at checkout. AfterPay's future lies in turbo-charging impulse purchases driven increasingly through direct to customer marketing campaigns. AfterPay's highly engaged users (Average of 6.5 transactions per year v/s Affirm's 2.3 transaction) provides it an advantage by generating rick SKU-level data to train predictive models for targetted advertising and marketing campaigns. AfterPay is a bet on the power of marketing; Affirm is a bet on the power of credit.